reit dividend tax uk

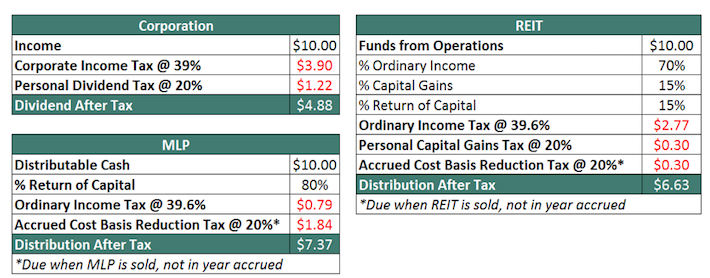

EPIC Name Market Cap m Dividend Price to Book Sectors. The net amount of cash received 80 in the example at GREIT08515 SAIM20000 is shown.

Real Estate Investment Trusts Tax Adviser

Our REITS Table shows 45 UK-listed REITs Click on the REIT to see more Yahoo Finance Data.

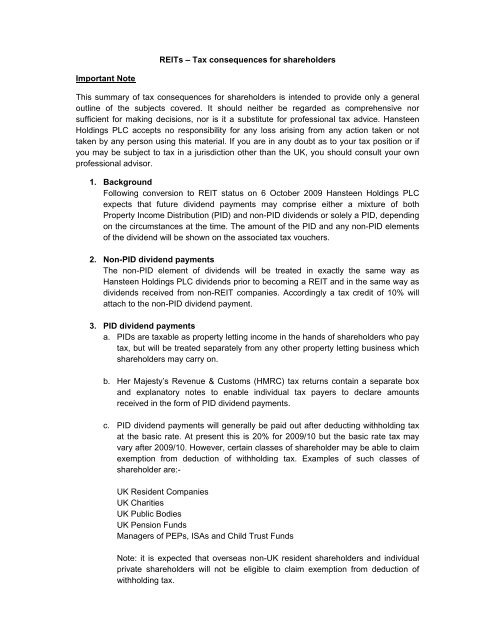

. Please note that the tax-free dividend allowance does not apply to the PID element of the dividends. Any non-PID dividends will be treated the same as ordinary. To work out your tax band add your total dividend income to your.

AEW UK Long Lease REIT Plc. Im looking to invest in a UK REIT ETF specifically IUKPL through a US investment platform called Interactive Brokers IBKR. It offers exposure to a portfolio of Urban and Big box warehouses in Europe with a combined value of 184b.

Non-taxpayers could not claim. But over the next decade this is a market tipped for fast growth. Investor After tax return from UK company After tax return from UK REIT Enhancement of return UK.

You do not need to pay taxes on dividends you generate from your individual savings accounts ISAs. Delayed share data provided. This tax credit met the tax bill for starting rate and basic rate taxpayers.

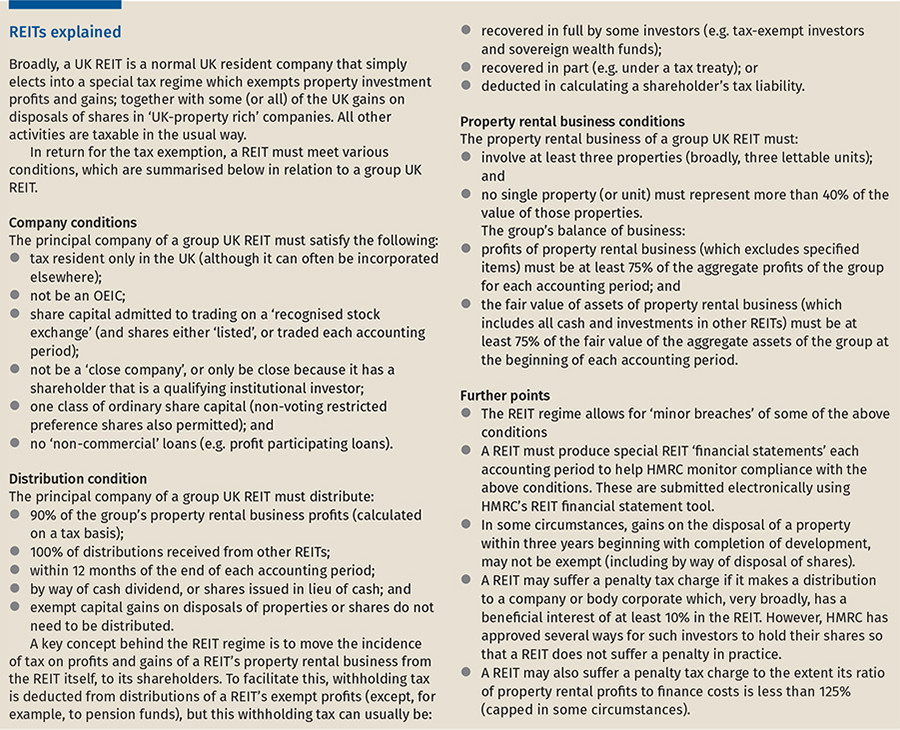

The highest effective tax rate on qualified REIT dividends is usually 296 percent taking into account the 20 percent deduction. Tax rate on dividends over the allowance. A UK-REIT is either a company or group that carries on a.

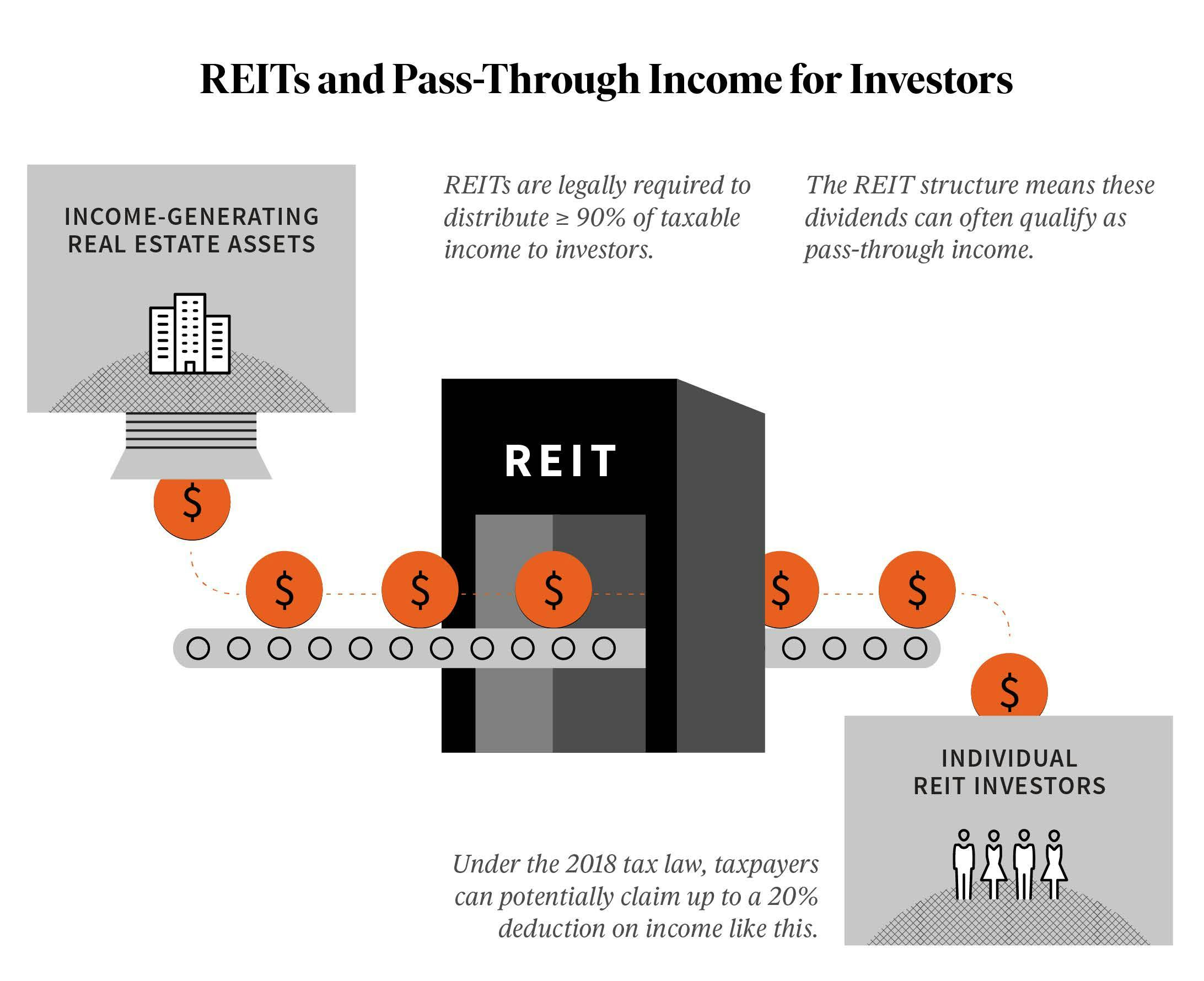

The REIT is required to invest mainly in property and to pay out 90 of the profits from its property rental business as measured for tax purposes see IFM22050 as dividends to. My understanding is that. I have no UK income.

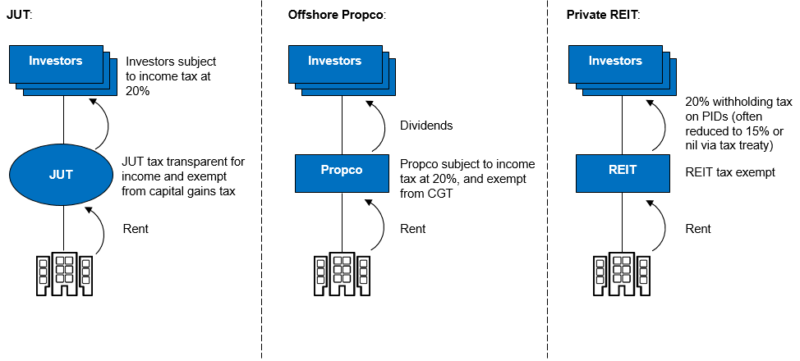

Income profits and capital gains of the qualifying property rental business of the REIT are exempt from corporation. This corporation tax is paid by the company before any dividends are paid out to investors. Part 12 of the Corporation Tax Act 2010 provides for a special tax regime for Real Estate Investment Trusts UK-REITs.

AEW UK REIT Plc. A normal UK company is required to pay Corporation Tax on profits at a rate of 19. The largest UK REIT is Segro SGRO with a market cap of 124b.

REIT dividends and UK tax Scrip dividends IR contact information FAQs IR calendar Regulatory news Share price. For example if the UK-REIT paid a normal dividend of 90 the tax credit was 10. A REIT are not eligible for the annual dividend tax allowance which is 2k in 202122.

Here is a full list of every UK REIT listed on the London Stock Exchange at the date of writing listed in alphabetical order. 4 hours agoOkay tough economic conditions could strike demand for so-called big box properties in the near term. A corporate shareholder or a shareholder treated as a company for treaty purposes wherever tax resident who holds 10 or more of the shares or voting rights in a UK REIT is regarded.

For individuals who do receive tax returns the PID from a UK-REIT is included as other income. In the following instances however REIT. REIT dividends and UK tax Scrip dividends IR contact information FAQs IR calendar Regulatory news Share price Open link menu.

The main tax implications of electing for REIT status are. Hence you do not need to pay taxes on the REIT dividends you get from your ISA.

How To Value Reits In 2022 Real World Examples

Emergence Of Real Estate Investment Trust Reit In The Middle East

Cracks In Consumer Global Inflation Reit Dividend Hike

3 Quality Reits To Buy With Secure Dividends

Taxation Of Real Estate Investment Trusts Tax Systems

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Reits 101 A Beginner S Guide To Real Estate Investment Trusts Fundrise

Do You Pay Taxes On Reit Dividends In Uk

Why Reit Dividends Are A Game Changer For Investors The Motley Fool

Reits Real Estate Investment Trusts Explained

/AreREITsBeneficialDuringaHigh-InterestEra4-dbc06be2b2644060acc3bf1f7fe7aa37.png)

Are Reits Beneficial During A High Interest Era

Uk Reit Conversion And Institutional Ownership Dynamic Emerald Insight

The Continuing Rise Of The Reit

Reits Tax Consequences For Shareholders Hansteen Holdings Plc

How To Invest In Reits In September 2022

Tax On Reit Dividends And Uk Dividend Tax Panda Boss

Taxation Of Reits Ringing In The Changes

The Effects Of Shifting Tax Regimes An International Examination Of The Reit Effect Semantic Scholar